From 1914 to 1965, BNP Paribas’ ancestor banks developed and reinvented themselves despite a series of political and economic crises.

The inter-war period: time for consolidation

In 1913, Comptoir d’escompte de Mulhouse, which was in German territory until 1918, created a French subsidiary, Banque Nationale de Crédit (BNC), which grew and took over its parent company in 1930. This bold and dynamic institution built up a network by acquiring several local French banks. In 1922, it merged with international merchant bank Banque Française pour le Commerce et l’Industrie. Through this merger, the bank was able to develop its commercial activities, but became too involved with some of its clients and went bankrupt during the 1930s recession.

The bank was re-established in 1932 as Banque Nationale pour le Commerce et l’Industrie (BNCI). It was headed by the highly talented Alfred Pose, who was appointed Chief Executive Officer at just 33 years of age. The bank set itself apart with its commercial momentum and innovative way of handling transactions with the creation in 1934 of “back offices”. At the same time, Paribas, under the leadership of its CEO Horace Finaly, revived its partnerships with industry – particularly the oil industry – and strengthened its presence in Central Europe, where it represented French interests.

BNP Paribas forerunners’ and the War

During World War I, BNP Paribas forerunners’ in France worked alongside other financial institutions to encourage citizens to contribute their savings to the war effort. Many bank employees also sacrificed their lives in service of their country. By the end of the war, the French franc had lost a hefty portion of its value which, along with the demarcation lines in Europe, greatly affected Paris’ position as an international financial centre. New sources of growth had to be found.

1945-1965: a period of modernisation

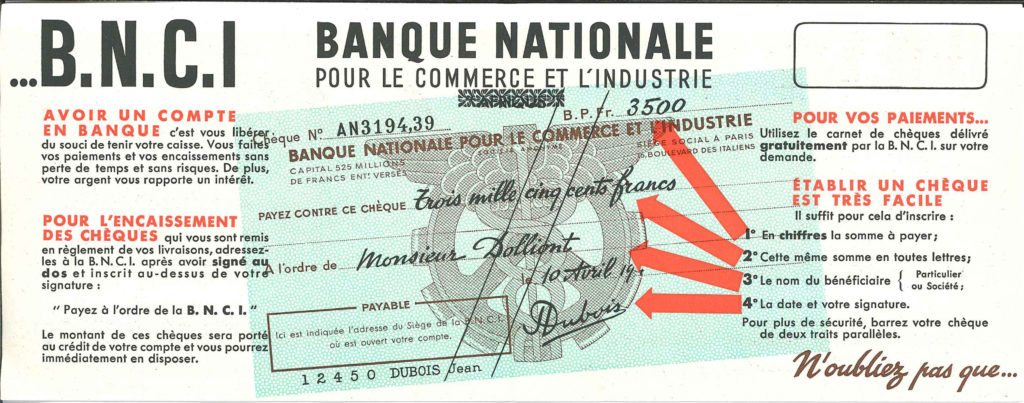

After the sharp drop in activity during World War II, when banking networks abroad were cut off from their Paris headquarters, the Group’s predecessor banks began to shift their efforts towards reconstruction. In 1945, the Banking Act separated merchant and investment banks from commercial banks, and the government nationalised the four largest financial institutions to help the country recover economically. CNEP and BNCI were nationalised and chose to operate as deposit banks. CNEP continued along a cautious path, while BNCI, which had built up a large international network since the war, remained competitive and innovative, becoming the first bank to advertise on the radio in 1954. New products such as personal loans (1959) and SICAVs (open-ended mutual funds) (1963) were offered to clients.

Paribas chose to operate as a merchant bank and was not one of the four nationalised banks. After the war, it became known for financing major international projects that supported French industrial exports, such as the Paz del Rio steel mill (1950) in Colombia. Under the leadership of Jean Reyre, Paribas reaffirmed its ambitions on the international scene, particularly in Europe. The bank forged new alliances, participated in the introduction of buyer credit for foreign trade finance in 1965, and played a pioneering role in the emerging Eurocurrency market.