BNP Paribas Group businesses in the Netherlands for 150 years

BNP Paribas Historical Collections

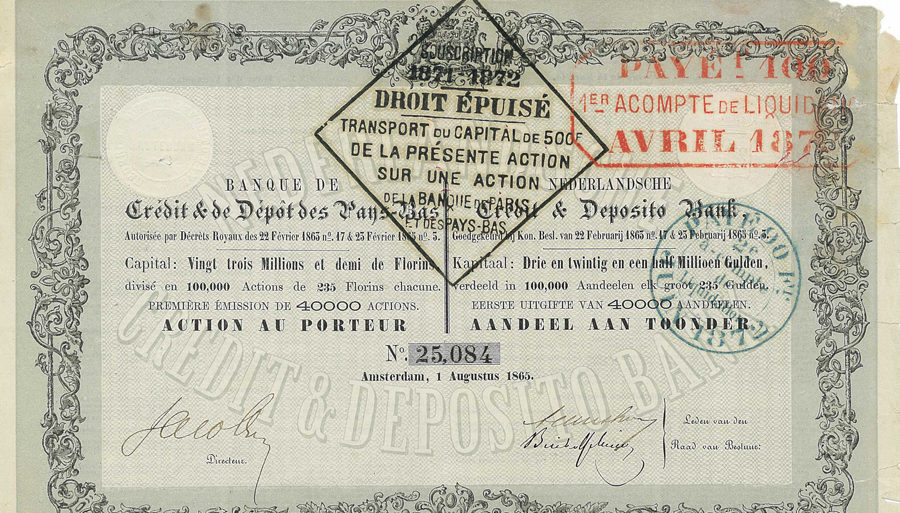

The history of BNP Paribas in the Netherlands goes back a long way and starts with the foundation of the Nederlandsche Credit-en Deposito Bank (NCBD), Paribas forerunenr. This bank set up at the heart of the Amsterdam financial marketplace in 1863.

Founding of the Nederlandsche Credit- en Deposito Bank

The Nederlandsche Credit- en Deposito Bank (NCDB) [Dutch Credit and Deposit Bank] was founded in Amsterdam in 1863 on the initiative of Louis-Raphaël Bischoffsheim, together with his relatives and allies the Bamberger family, Maurice de Hirsch and Meyer Joseph Cahen d’Anvers. Its backers also included Alphonse Pinard and Édouard Hentsch of the Comptoir National d’Escompte de Paris. Dr Samuel Sarphati, an enthusastic Dutch promoter of economic and social progress who was also among the founders, became the first person to chair the NCDB Management Board.

NCDB merges with the Banque de Paris

In 1872, NCDB merged with the Banque de Paris, which had been founded in 1869, to form the Banque de Paris et des Pays-Bas (widely known as Paribas), which set up its headquarters in the rue d’Antin in Paris. Meanwhile, the NCDB business was transferred to the new Amsterdam branch of the Banque de Paris et des Pays-Bas.

Amsterdam branch active in the securities market

During the 18th century, Amsterdam had been the foremost financial marketplace in Europe. Although its influence had waned considerably by the mid-19th century, the city continued to play an important role, especially in the trading of US company securities. In the first half of the 20th century, large numbers of European borrowers chose Amsterdam as the place to launch their bond issues due to its reputation for stability. Highly regarded in the Amsterdam market thanks to the influential figures who made up its Supervisory Board, the Dutch branch of the Banque de Paris et des Pays-Bas participated in a number of deals, frequently alongside the Nederlandsche Handel-Maatschappij (Netherlands Trading Society).

Evolution of the business model (1945-1968)

The branch set out to develop commercial banking activities, including corporate lending and international trade finance, and also set up a number of specialised companies, while remaining an active participant in capital market deals.

Rapid, uncontrolled expansion

In 1968, the status of the Amsterdam establishment was changed from that of branch to subsidiary company, under the name Paribas Nederland N.V. It then began to focus on retail banking activities, opening a large number of branches. However, the subsidiary did not have the necessary resources to support this rapid growth. Substantial losses posted in the late 1970s forced the bank to alter its strategy and Paribas Nederland returned to profitability in 1994 but in 1997, when Paribas decided to concentrate on its traditional activities and divest its retail banking businesses, the Dutch subsidiary was sold off.

Growth of BNP Paribas business lines in the Netherlands

When the BNP Paribas Group was formed in 2000, the branch which BNP had opened in Amsterdam in 1977 became the BNP Paribas branch. The branch is active in international trade finance, corporate lending, currency trading and Treasury services. The Group’s insurance arm, BNP Paribas Cardif, has also been working in the Netherlands since 1995.

Since then, a number of Group business lines have set up in the Netherlands – CIB (2000), BNP Paribas Securities Services (2001), BNP Paribas Personal Finance (2003), BNP Paribas Leasing Solutions (2004), Arval (2004), Wealth Management (2005) and BNP Paribas Real Estate (2012).

Partager cette page