A promising industry meets a daring bank (2/3): the BNC and the Gaumont-Franco-Film-Aubert group

Rotunda of the Paramount movie theatre, located Boulevard des Capucines in Paris, 1930's - BNP Paribas Historical Archives

Moviemaking, an industry that first appeared in the late 19th century, required substantial investments from the outset. Though few commercial banks chose to be involved with this emerging business, the Banque Nationale de Crédit (BNC), forerunner of BNP Paribas, played an active role in financing the world of cinema between 1917 and 1932.

The BNC yokes its destiny to the Gaumont-Franco-Film-Aubert group (GFFA)

Cinema was considered a tool for promoting French culture and, as such, was supported by the State, so as to compete with the big American companies. Also, in the 1920s, the sector’s heavyweights – Pathé, Gaumont, and Aubert – were consolidating all the industry’s activities into major groups. With the advent in France of “talkies” (films with a soundtrack) in 1929, film companies required much more substantial financial resources. They therefore entered into major real-estate investment deals to further monetize their direct revenues from theater screenings.

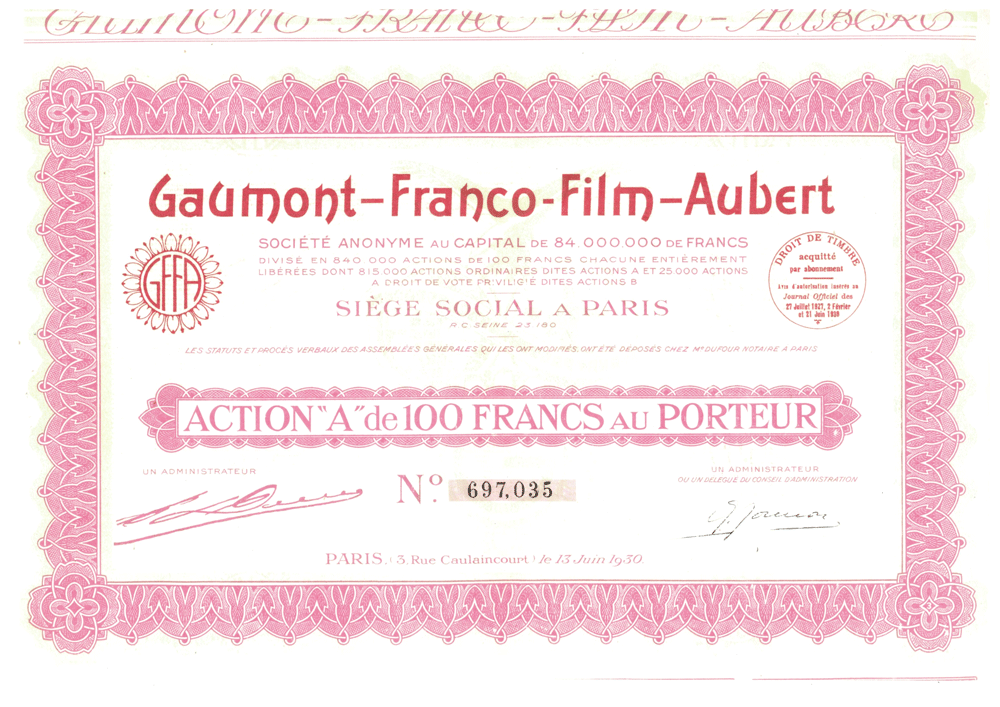

This was the context in which the BNC began supporting formation of the Gaumont-Franco-Film-Aubert group in April 1930 and invested in its capital. The goal was to create a company that encompassed all facets of the movie business, following the model of the Hollywood majors: technical production, production, and distribution.

In 1931, France’s fourth-largest commercial bank granted a loan of 46 million francs (more than €27 million in 2016 euros) to renovate the Gaumont Palace, a legendary movie theater in Paris’ 18th arrondissement. Boasting the largest screen in Europe – surpassing 59 by 47 feet – and 6,000 seats, the new theater was also designed for talkies. In 1932, the Gaumont-Franco-Film-Aubert group was the third-largest film producer in the world.

Read also

Partager cette page