The Banque nationale de crédit (1913-1932)

Identification

- Date range: 1913-1962

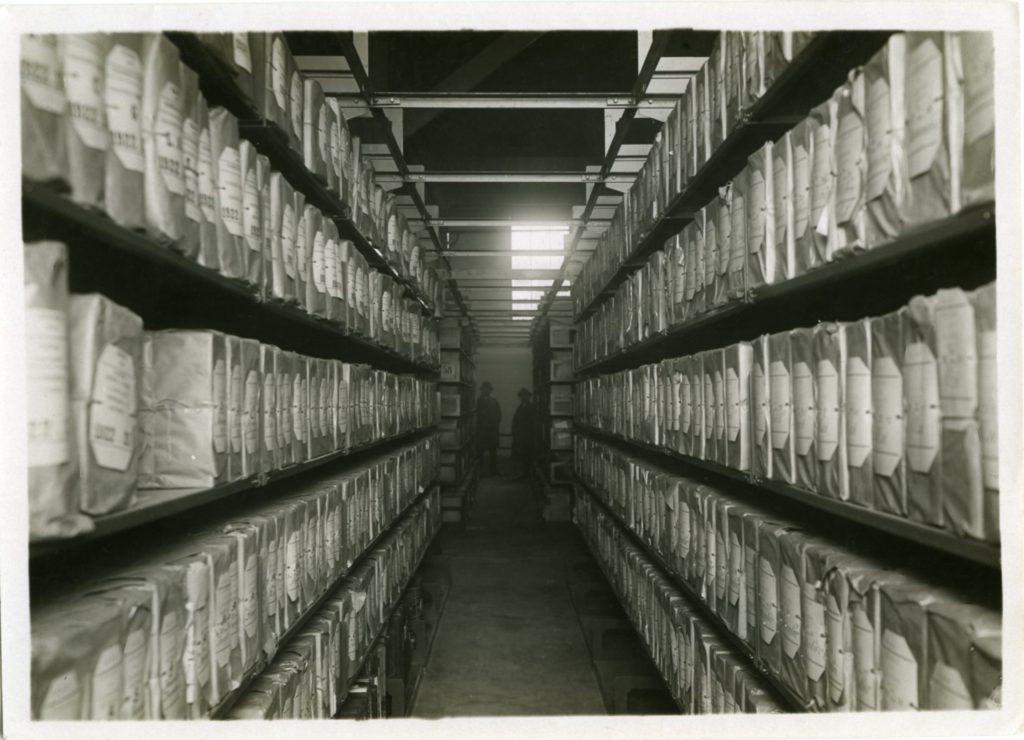

- Physical description: paper archives, photos, posters

- Volume: 263 in UA

- Physical location: National Archives of the World of Work (ANMT)

Conditions for access and use

- Access condition: communicable with authorisation

- Language: French

Background

Part of the archives of BNC and its liquidation was handed over to the National Archives on 20 November 1968 by Banque Nationale de Paris, resulting from the merger in 1966 of BNCI and Comptoir National d’Escompte de Paris; this was made possible thanks to Paul Macé, one of the liquidators and technical advisor to BNP, who considered it necessary to save from destruction documents that traced the main activities of this leading credit institution and its liquidation. In an historical record, which also contains a summary of the documents he sorted and selected for preservation, Mr. Macé retraced the history of the BNC archives. First assembled in the liquidation premises in Boulogne-sur-Seine, the archives were transferred in 1962, after significant destruction, to a BNCI warehouse at 132 quai de Jemmapes; they were then reduced to 1.2 km, and BNCI was to ensure its conservation for 10 years, in accordance with the agreements concluded with BNC at the time it ceased activity and with the decision of the final general shareholders’ meeting of 23 November 1962(6).

The collection is of interest for the history of BNC and its subsidiaries, as well as their liquidation; it also reflects the economic history of the period between the wars and holds a mine of financial information on a large number of very diverse companies, on which we have absolutely no information.

Important supplements on the liquidation of BNC and the constitution of BNCI, as well as on some of the main debtors (Comptoir Lyon-Alemand, Marcel Boussac, SA des Aciéries et Forges de Firminy, Établissements Carel, Fouché et Cie, Lorraine-Dietrich, Gaumont-Franco-Film- Aubert, etc.) can be found in the Finance Ministry archives under F30 2808 to 2822 in the National Archives. In addition, article F30 1039 contains a file relating to a proposal made in 1926 by BNC to amortise the 1918 loan from the French government to Banque de la Nation in Buenos Aires over ten years, by means of orders from the Argentine government to be executed by French industry (armaments, metallurgy), and to be paid for through the issuance of an Argentinian government loan on the French market; the project was rejected on the advice of the Mouvement Général des Fonds department. Finally, a small file under F30 2398 concerns BNC debt repayments in Germany in 1933.

History

Banque Nationale de Crédit (BNC) was officially created on 25 June 1913, with a capital of 100 million francs, and took possession of the French network of Comptoir d’Escompte de Mulhouse (CEM) on 1 July 1913. It was chaired by Georges Cochery, former Finance Minister, and managed by Eugène Raval, also a director, who took over from Cochery on his death in August 1914. The board of directors also included defectors from CEM, Gustave Favre, Arnold Seyrig and Léon Dardel, as well as Jules Siegfried, former Trade Minister, René Boudon and Charles du Peloux, the chairman and director of Banque Française pour le Commerce et l’Industrie (BFCI, a.k.a. Banque Rouvier).

Between 1913 and 1920, BNC pursued a policy of both internal and external growth. In 1913, it opened new agencies in the North and in Languedoc, absorbing around thirty local and regional institutions, including Banque du Midi, Crédit du Centre, Crédit du Sud-Ouest, Banque de Nancy and Banque de Metz. In 1922, it had no less than 442 agencies, including 188 branches. Discounting operations constituted half of its operations, and the bank actively contributed to financing public expenditure, particularly in relation to the war effort. BNC would also be the only French bank not to use the state moratorium in 1914 freezing deposits and debts. This initiative found favour with the public and during the period of growth in the 1920s, thanks to this confidence that it was able to win, it would greatly benefit from the influx of savings from individuals and businesses. From 1913 to 1930, it increased its number of counters by a factor of eight (751 in 1930, including nearly 400 permanent).

On 1 September 1922, it merged with BFCI, BNC providing its deposit collection network and BFCI providing its business portfolio. This merger allowed it to cement its place in the business world. Most of the former BFCI executives were on the board of directors, like René Boudon, who became chairman of BNC after Eugène Raval, Maurice Devies, Maurice Lépine, Henri Bousquet. Other men of influence joined the BNC board, including Pierre Richemond, who came from metallurgy and bringing with him a network of 80 industrialists in the sector (Renault, Fives-Lille, Peugeot, Lorraine-Dietrich), and André Vincent, formerly of Forges et Aciéries in Firminy and Comptoir Lyon-Alemand (the leading metal transformer in France), who joined the management committee in 1919 and became chairman in 1927.

A partnership was thus established with a number of French industries. In addition to loyal clients (Tréfileries et Laminoirs du Havre, the relationship with which dated back to the days of Banque Internationale de Paris in 1900-1903, and SACM), the bank supported new relationships: the group of Marcel Boussac, of which it became one of the main bankers, Citroën, Péchiney, Thomson-Houston. BNC granted its corporate clients overdrafts and cash facilities for three to six months on a renewable basis, and granted longer loans (four to 12 months), based on guarantees. This new way of doing business tied up a significant portion of its assets.

Abroad, it opened an office in London in 1928, which enabled it to support SCOA (Société Commerciale de l’Ouest Africain) in its trading between the UK, France and French-speaking and English-speaking black Africa. In 1929, it took part with its counterparts in the creation of Banque Française d’Acceptation. Thanks in particular to the relationships forged by BFCI, which had created Banque Française des Pays d’Orient in 1921, it also rolled out its activities in Eastern Europe, financing Turkish and Greek exports to Europe.

BNC thus became the fourth largest deposit bank in France behind Crédit Lyonnais, Société Générale and Comptoir National d’Escompte de Paris (CNEP).

In the 1920s, the bank very early on supported “new” industries, in the fields of aeronautics (Société Générale d´Aéronautique – SGA) and cinema (Société Gaumont-Franco-Films-Aubert) among others. Like many other companies and sectors, these companies were hit hard by the crisis and were bankrupted in the early 1930s.

Thus, after becoming a prosperous bank and absorbing Comptoir d’Escompte de Mulhouse (CEM) in 1930, it sank into the crisis of the 1930s, dragged down by its main shareholder, the group of industrialist André Vincent, who became chairman of BNC in 1927, but also a major BNC shareholder and client. As Chairman, André Vincent took control of the financial institution. Within three years, the bank found itself reduced to simple dependence on an industrial group that it supplied with loans: while it continued to conduct its day-to-day deposit banking business, a team of financiers made a large portion of its resources available to the Vincent group. However, following the 1929 crisis, the international situation turned around from 1930, and the Vincent group was faced with a structural cash flow crisis: in 1932, of the 35 largest debit accounts held at BNC, 15 were held by companies attached to the Vincent group.

In 1931, confidence eroded, the bank’s share price collapsed, the rush to withdraw deposits from the bank accelerated, and the State decided to intervene to set up a guarantee fund, liquidate BNC and reconstitute it on a sound basis on 12 January 1932.

Thus, following the decision taken on 26 February 1932 at the extraordinary general meeting under the auspices of political authorities and consular institutions, a new institution was established on the rubble of BNC on 18 April 1932, Banque Nationale pour le Commerce et l’Industrie (BNCI). The liquidation of BNC, meanwhile, would take 30 years: everything that was able to be preserved – the headquarters, counters, staff, available assets, the balance of deposits, was transferred to the new institution. Long-term debt still needed to be recovered, first and foremost the money advanced by the Treasury, Caisse des Dépôts et Consignations as well as Banque de France. In 1962, Finance Minister Valéry Giscard d’Estaing signed off the end of the BNC liquidation: by settling bad debts over 30 years, some of which recovered in value, the liquidation was ultimately profitable.

Additional sources

65 AQ A214, articles of association (1913-1930), general meetings (1914-1962), notices (1913-1953), press clippings (1913-1959), various lists (1925-1927), various notes (around 1930), advertising calendar (1923).

155 AQ, BNCI Archives

Banque de France archives.

Crédit Lyonnais archives.

At CHAN :

F30 1039, Franco-Argentinian Loans (1926).

F30 2398, Debt repayment in Germany (1933).

F30 2808-2822, Liquidation of BNC and main debtors.

Bibliography :

H. BONIN, La Banque Nationale de Crédit : histoire de la quatrième banque de dépôts française en 1913-1932 [The National Credit Bank: history of the fourth largest French deposit bank in 1913-1932], Paris, 2002, 238 p.

Charles-Albert LUCAS, Pierre PASCALLON, Albert-Buisson, un destin au XXe siècle (1881-1961). Essai sur une prodigieuse réussite sociale française [A destiny in the 20th century (1881-1961). Essay on a prodigious French corporate success.].

Collection kept at the National Archives of the World of Work (ANMT)

Presentation of content:

Company documents; circulars; litigation files; discount records; accounting; liquidation; subsidiary files.

| 120 AQ 33-90 | Company documents: articles of association, annual reports, minutes of the board of directors and management committee | 1913-1932 |

| 120 AQ 91-130 | Circulars. | 1913-1932 |

| 120 AQ 131-236 | Litigation: files on the opening of company accounts. | 1916-1932 |

| 120 AQ 237-259 | Discount files: companies (mainly located in Paris) in ongoing relationships with BNC. | 1919-1932 |

| 120 AQ 260-446 bis | Accounting: general accounting (1913-1932); cost accounting (1913-1932); statistics and special accounts (1923-1932); statement of commitments (1931-1932). | 1913-1932 |

Liquidation of BNC

| 20 AQ 447 | General meetings | 1932-1962 |

| 120 AQ 449-503 | Board of liquidators and sub-committees. | 1932-1962 |

| 120 AQ 504-513 | Liquidation Committee | 1936-1957 |

| 120 AQ 514-532 | File of cases handled. | |

| 120 AQ 533-547 | Organisation of the liquidation and creation of BNCI. | 1923-1959 |

| 120 AQ 548-550 | Directors’ files | 1928-1953 |

| 120 AQ 551-552 | Correspondence. | 1932-1953 |

| 120 AQ 553-554 | End of liquidation. | 1932-1968 |

| 120 AQ 555-589 | Financial services: transfer of securities to BNCI. | 1965 |

| 120 AQ 590-729 | Debtors’ files (including 660 to 677: diamond cases) and commercial settlements. | |

| 120 AQ 730-741 | Civil and judicial litigation. | 1908-1956 |

| 120 AQ 742 | Personel matters | 1926-1958 |

| 120 AQ 743-748 | Building-related matters. | 1930-1962 |

| 120 AQ 749-755 | Tax matters: BNC and foreign companies represented by BNC in France | 1912-1951 |

| 120 AQ 756-757 | Foreign relations: debt collection. | 1920-1956 |

| 120 AQ 758-781 | Personnel liquidation. | 1923-1963 |

| 120 AQ 782-877 | Accounting | 1931-1962 |

| 120 AQ 878-892 | Buildings et archives. | 1774-1960 |

| 120 AQ 893-896 | Taxes | 1920-1960 |

BNC subsidiaries

| 120 AQ 897-989 | Banque française pour le commerce et l’industrie. | 1901-1955 |

| 120 AQ 990-991 | Compagnie française d’immeubles. | 1919-1944 |

| 120 AQ 992-1001 | Banque française des pays d’Orient. | 1921-1957 |

| 120 AQ 1002 | Comptoir d’escompte des pays rhénans. | 1920-1925 |

| 120 AQ 1003 | Banque française d’acceptation. | 1929-1944 |