Claude de Kemoularia (Paribas) and Carlos Andrès Pérez, president of he Venezuelan Republic, sign the financing agreement for the 3rd line of the Caracas Metro

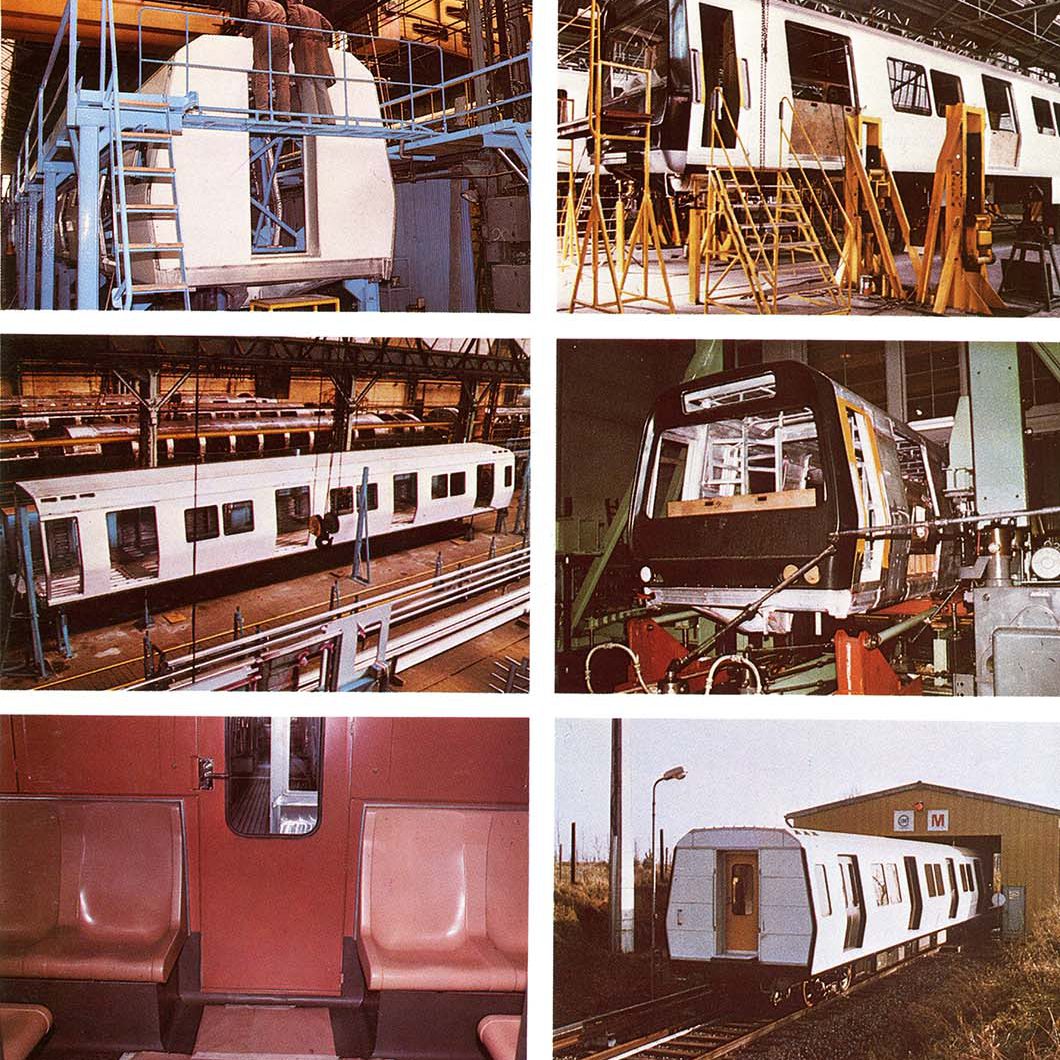

The construction of the Caracas metro was a leading industrial operation that began at the end of the 1970s.

This photo shows Claude de Kemoularia, advisor of the Paribas CEO for international affairs from 1968 to 1982 and Carlos Andrès Pérez, president of Venezuela, meeting in Paris on 30 May 1991, for the signing of the financing agreement for the 3rd line of the Caracas Metro. The 1.6 billion French franc loan saw Paribas act as the lead banker of a consortium formed with Société Générale and Crédit Lyonnais, the metro management company and the Frameca Economic Interest Group bringing together among others GEC-Alsthom, Cegelec, Spie Batignolles, Matra Transports, Suseca, ANF Industrie, Montcocol CSEE Transports and SGTE. The first and the second metro lines were commissioned in 1983 and 1987.

Export credits, a speciality of Paribas

In the beginning of the 1950s, Paribas restarted its international trade financing activities and, in particular, for capital goods exports and French industrial projects abroad. The bank developed, at the behest of Jean Reyre, an ingenious credit system over five years that was able to overcome the shortage of foreign currency. The principle? Rather than lend in dollars (too rare) to the equipment buyer, the bank loaned in French francs to the French manufacturer that produced the equipment. And the manufacturer reimbursed the bank as the payments in dollars flowed in from the foreign buyer.

Using this method in 1978, Paribas helped French manufacturers win the construction contract for the Caracas metro against their Japanese competitor, thanks to an innovative method of financing: the currency swap. In the French offer denominated in French francs, the annual credit increase ceiling was 8% versus 5% for the Japanese offer in dollars. Consequently, Paribas, in collaboration with the Morgan bank, organised the forward purchase of the dollars the Caracas metro had to deliver to cover the French credit due dates. This conversion in dollars made it possible to offer the Venezuelan buyer a 15% discount, which was decisive in the French EIG’s victory.