Banque Nationale de Crédit (BNC), the bank that grew too fast

In around fifteen years, through sheer boldness and fighting spirit, BNC worked its way up to become the fourth largest French deposit bank.

Unprecedented commercial aggression

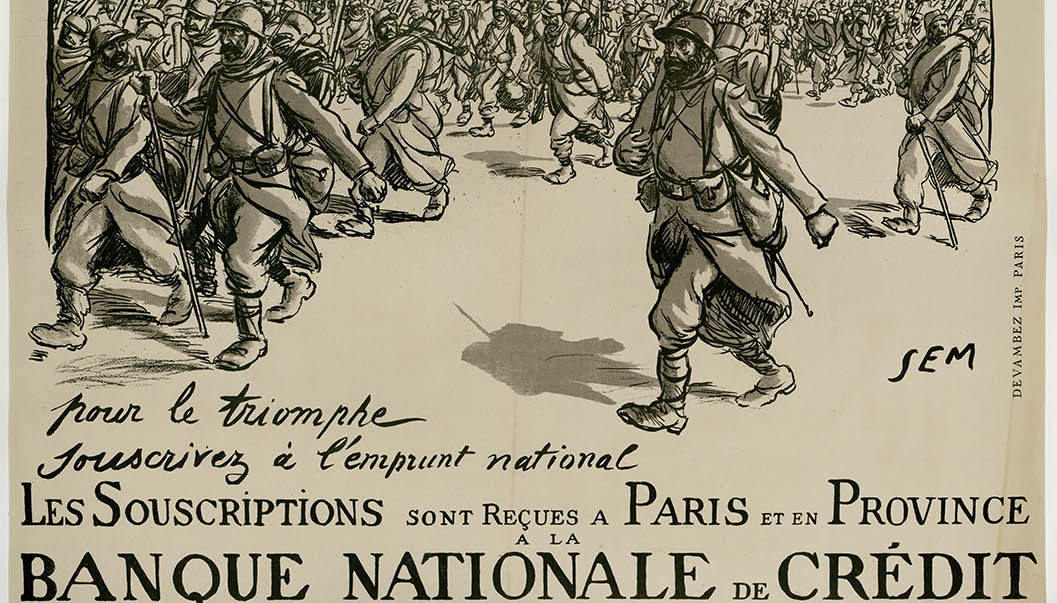

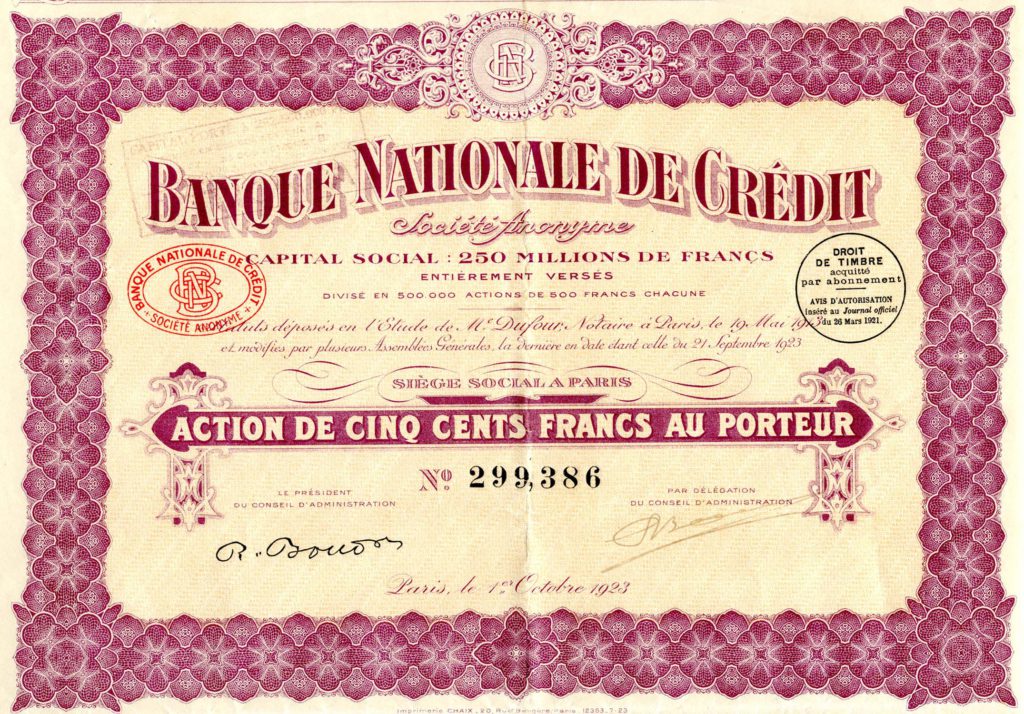

The Banque Nationale de Crédit (BNC) was established on 25 June 1913 to take over the business of the Comptoir d’Escompte de Mulhouse (CEM), its parent bank, which was then in German territory. From its first years of operations, it pursued an active policy of geographical expansion, taking over forty or so local and regional banks.

The strong fighting spirit and commercial aggression which drove the staff – for example the systematic canvassing of customers and prospects – enabled BNC to prise market share away from its competitors. The bank saw a sharp rise in deposits and posted substantial business growth, leading to successive capital increases. During the First World War BNC stood apart from its competitors in not applying the government moratorium designed to avoid mass withdrawals of savings.

Despite the 1920-1921 recession, BNC pursued its aggressive policies and continued expanding the branch network. The bank steadily built up close business relations with companies in a variety of sectors and brought influential men on to the Board. Partnerships were forged with a number of leading French manufacturing groups including Renault, Fives-Lille, Peugeot and Péchiney.

In 1926, the bank started building its new headquarters at 16 boulevard des Italiens in Paris, in ‘art deco’ style, using ultra-modern materials such as reinforced concrete.

The final years

In 1927, André Vincent, a dynamic and entrepreneurial partner who was also head of the Comptoir Lyon-Allemand, became BNC Chairman. Under his aegis, BNC further expanded its commercial banking activities, setting up daring financial deals and backing brand new industries such as talking cinema and aviation.

However, the accounts of the Comptoir Lyon-Allemand and BNC had gradually become closely entwined. Consequently, when the stock markets crashed, followed by economic crisis, the overdrafts granted to Vincent Group companies weighed heavily on BNC’s credit position. Despite desperate attempts by the public authorities to prop up the bank, BNC was liquidated in 1932. The new bank, Banque Nationale pour le Commerce et l’Industrie (BNCI), set up to take over its healthy assets, also took on the all-conquering vision originally conceived by Chairman Eugène Raval.

Partager cette page