Long before it established its countrywide network in France, the Comptoir d’Escompte de Paris (CEP) opened an office in China. For more than a century and a half, the various banks that preceded the Group were able to cope with the tribulations that punctuated modern history in China. But their presence, in various forms, also demonstrated that they understood the country’s enormous potential and were able to build lasting economic and financial relationships.

The period 1890-1820: the discreet but vital role of other forerunner banks in China

The forerunner banks of the Group’s other components, Paribas and Fortis, early on became intensely involved in the construction and modernisation of China.

Although Comptoir d’Escompte de Paris, which became Comptoir National d’Escompte de Paris (CNEP), became established as a pioneer in Asia, the Group’s other forerunners – Société Générale de Belgique (Fortis) and Banque de Paris et des Pays-Bas (Paribas) – were very active in China at different periods and paces.

They played a pivotal role in checking the power of British trade and finance in China: thanks to them, between 1890 and 1820, French and Belgian interests were deployed in eastern railways and banking centres, with Paris becoming a key player in the placement of Asian bonds.

Banque de Paris et des Pays-Bas (forerunner of Paribas) role

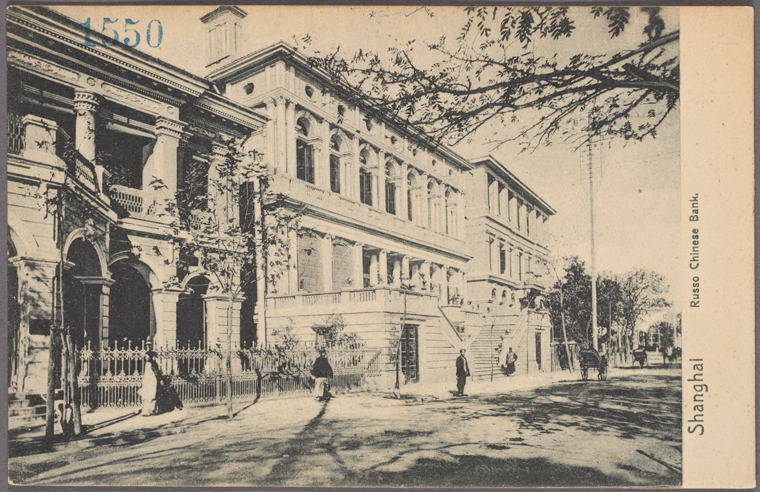

In October 1895, Banque Russo-Chinoise was set up in Saint Petersburg as a financial consortium of Russian and French capital around Banque de Paris et des Pays-Bas (Paribas), in which CNEP also held shares. The founding of this institution was linked to the Sino-Japanese War in 1895: to pay war indemnities following its defeat, China needed to issue a sizeable bond. Russia and France, associated by treaties of alliance since 1891, offered to help.

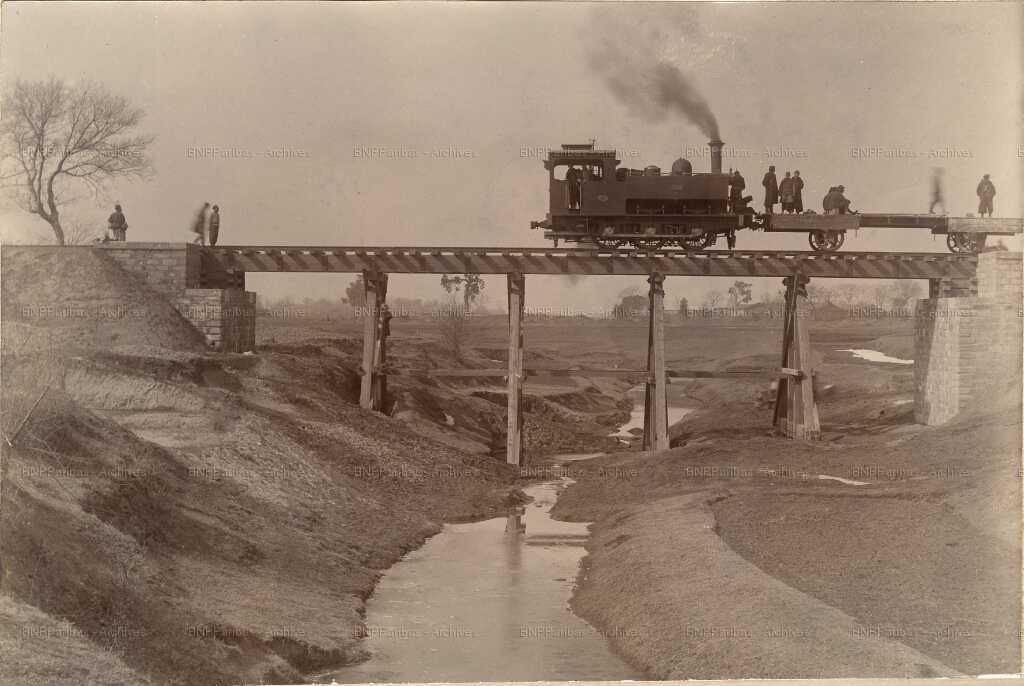

The French-Russian group was joined in March 1897 by Société générale de Belgique (Fortis), which in turn joined forces with Paribas to create Société d’Etudes de Chemins de Fer en Chine, a subsidiary that in July 1897 obtained the Peking-Hankou railway concession: 1,300 km of rail crossing the Great Plain of China from north to south and serving the empire’s capital, which lay close to the Russian sphere of influence, and right in the midst of the British sphere of influence. It was agreed that the Belgian partners would provide two fifths of the financing and the French banks three fifths, while the control would be divided equally between the two countries’ companies.

The project, which was one of the largest of the time and of vital importance to carry rice and sorghum supplies from the centre of China to Peking, was made possible by a call for French capital organised by Paribas and CNEP. The building of the railway line was completed in seven years (1898-1905), and the inauguration took place on 14 November 1905. It was to be of great benefit for Chinese authorities and investors alike. The high profitability of the line prompted China to buy the concession in 1909.

Société générale de Belgique (forerunner bank of Fortis) weight

Société générale de Belgique for its part expanded its influence in the Middle Kingdom from the start of the 20th century: following the Boxer Rebellion in 1899-1901, China was forced to pay indemnities to countries whose nationals had suffered from the insurgency.

It was to facilitate the payment of these indemnities to Belgium or its nationals that Générale created a bank subsidiary in China in March 1902, with the collaboration of the Ministry of Foreign Affairs: Banque Sino-Belge (which would become Banque Belge pour l’Etranger, BBE) immediately opened its first office in Shanghai. It handled exchange transactions, arbitration, guaranteed loans and import-export funding, and also issued local Dollar bills. A second branch opened in Tientsin in 1906, and a third in Peking in 1912. The establishment grew rapidly in Hong Kong (where it opened in 1935), and by the 1970s had a network of 13 branches there.

BNP Paribas Group’s forerunner banks therefore all shared a vision of the importance of investing in the building and reconstruction of China, each through its own expansion or financial influence strategies.