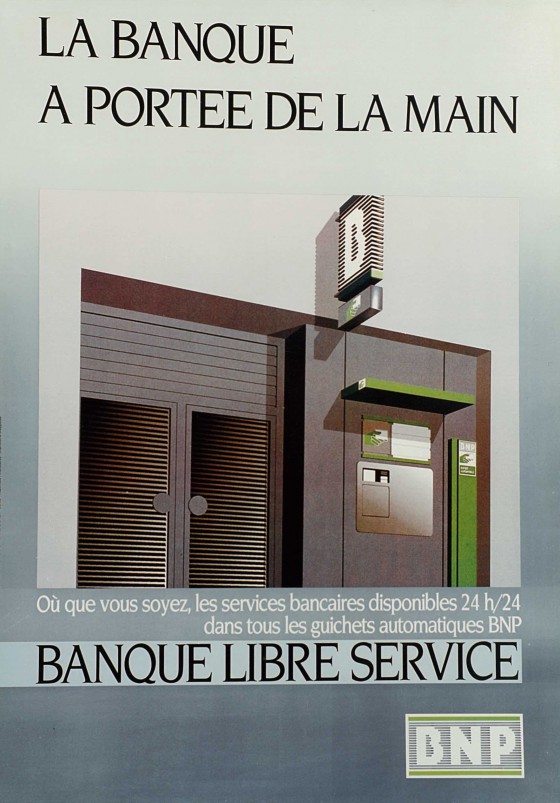

Banking at your fingertips, the self service bank

This poster shows an example of a BNP automatic teller machine. This is a case of emphasising self-service bank operations and services.

If the Carte Bleue experienced a difficult beginning in France, its distribution accelerated starting in 1981 with the introduction of Automatic Teller Machines (ATM), offering customers new services like consulting account balances or the history of the last 10 transactions, transfers and cash deposits. These transformations in the technical system profoundly changed the habits of customers, who previously performed these types of operations at the physical bank counter. This is how the concept of “self-service banking” gradually emerged, based on the widespread availability of powerful machines offering an expanded range of customer services. After the first installations in 1981 in Aix-en-Provence, Marseille and Paris, the number of ATMs continued to grow: 400 in 1984, 1400 in 1993 and 2180 at the end of1997.

Thanks to its powerful data processing, BNP was able to maintain the availability and reliability of its self-service tellers open 24 hours a day, 7 days a week.

Henceforth, the bank’s service role was handled to a large extent through ATMs and telecommunications, which didn’t exclude the consulting and product promotion activity in the branches. As a result, the branch area was subsequently redefined with a self-service part and a physical consulting part.