The birth of a giant: the story of the merger that created BNP in 1966

On May 4, 1966, the French learned through the radio about the birth of the Banque Nationale de Paris (BNP). It was born from the merger of the Banque nationale pour le commerce et l’industrie (BNCI) and the Comptoir national d’escompte de Paris (CNEP). Quick and efficient despite the surprise it caused, the merger was a resounding success. BNP was propelled to the rank of France’s leading bank.

Create a “financial striking force”

The announcement of the merger by the government on May 4, 1966, caught everyone off guard. Even the leaders of the two banks had only been informed three days earlier by Michel Debré, the Minister of Finance. His haste was intended to prevent rumors and ensure the success of this long-planned project.

At the time, Michel Debré was engaged in economic reforms aimed at stimulating the development of banks. In a context of banking concentration, it was necessary to equip France with a “financial striking force”: this was achieved with the creation of BNP. This served as an example to be followed by other major French banks.

The goal was to create a modern bank that would serve the national economy, be able to adapt to the European common market, and whose influence would enhance Paris’s position in the international financial world. BNP was designed to be a powerful financial instrument, capable of competing with other major European banks and promoting French economic interests abroad.

The name of the new bank reflects its ambition:

- Banque

It replaces the old expressions of “Comptoir” and “Commerce and Industry”. This marks the entry into modernity of a multi-purpose bank.

- Nationale

Because, like its two predecessor banks, BNP is a nationalized bank.

- Paris

To embody the prestige of the capital city, a global hub, and a true brand image.

The merger, a happy marriage?

From an accounting perspective, it’s a guaranteed success: BNP becomes the leading French bank, the second in Europe, and the 7th worldwide in terms of balance sheet.

Moreover, the two banks are complementary: CNEP benefits young BNCI with the experience of a century-old institution.

However, it remains a fundamental challenge to merge two companies into one. Especially since the two banks have very different cultures: tradition and respectability for CNEP, modernity and commercial flair for BNCI.

Following the merger, BNP has 35,000 employees, a record in the industry! The payroll is reorganized without layoffs, in accordance with the commitments made. BNP’s statutes are ratified by the “Commission des 22”, composed of two representatives from Management and twenty union representatives.

However, for the entire staff concerned, the surprise is total. Officially, the merger is immediate, but the old identities persist for a while, during which time employees must adapt.

“To give you an idea of how much this merger affected us, it’s that in the months and even years that followed, when we were from CNEP, we wouldn’t even say it out loud!…”

The teams are quickly merged, employees are trained to learn the methods of the former competitor, and joint projects soon begin.

Despite these difficulties, BNP maintains its commercial dynamism in a context of massive banking expansion in French society. Ultimately, three years will be enough to make this merger a success.

Two key men behind the success of the merger

The success of the merger also owes a great deal to the understanding and complementary skills of BNP’s leaders.

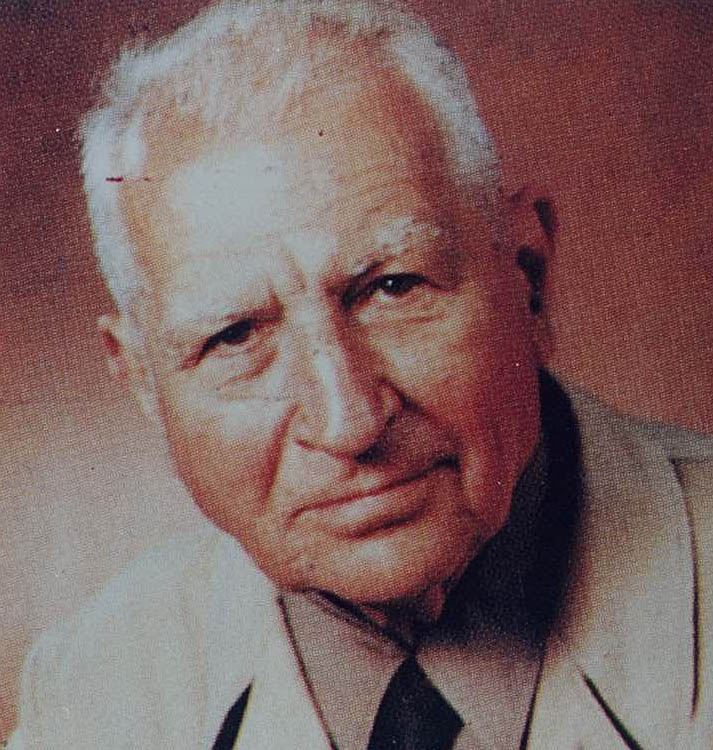

Henry Bizot (1901-1990)

After a brief stint in politics, he joined CNEP in 1930 as Secretary General. After surviving the war and serving with the Free French Forces, he was appointed Director General of the establishment in 1958, and then President in 1964. Before becoming President of BNP, Henry Bizot was already seeking to modernize CNEP, which was deeply rooted in its traditions.

After the merger with BNCI, Henry Bizot would serve as President of BNP until his retirement in 1971.

Pierre Ledoux (1914-2005)

Having served with the Free French Forces during World War II, he later became a Financial Attaché for the Quai d’Orsay. In 1951, he joined BNCI as Secretary General, bringing his international experience to the role. He went on to become Director General of BNCI-Africa and then of BNCI in 1963. Following the merger, he became Director General of BNP, and later President in 1971.

Pierre Ledoux internationalized BNP, supported its bold communication strategy, and initiated the historic partnership with Roland-Garros.

Make a name for itself

In 1966, the French population is not yet fully banked. To avoid losing customers to the competition from other banks during this pivotal period, the new bank decides to launch a major press campaign to reassure its customers and offer the promise of better services.

But first, the public needs to recognize this new bank! BNP must quickly impose its name and expertise on the public. In 1966, its logo with raised letters is displayed everywhere in public spaces.

Despite the challenges, questions, and difficulties related to the merger, BNP was able to overcome the obstacles and established itself as a market leader.

Even the storm of strikes in May 1968, which could have brought down this still fragile structure, did not derail the merger. By the early 1970s, the public was just as familiar with BNP as with other banks, and the number of accounts opened at BNP had more than doubled. This is what is called a successful merger.