This savings & pensions institution took steps to adapt to a rapidly-changing world by changing its status successively from savings bank to State-owned bank to privately-owned bank.

A national institution to promote savings

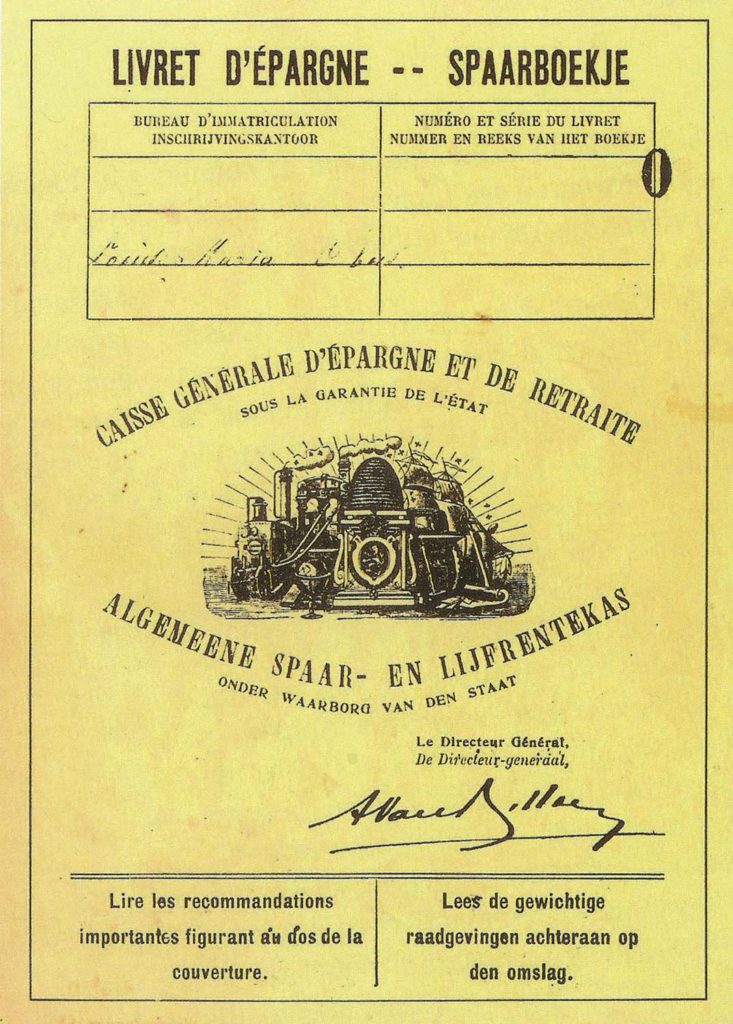

The Belgian authorities began to encourage individual savings in the 1850s with a view to improving the standard of living of working people. In 1850, the government set up the Caisse d’Epargne (savings bank), which merged in 1865 with the Caisse de Retraite (retirement savings fund) to form the Caisse Générale d’Epargne et de Retraite(CGER), known in Dutch as the Algemene Spaar- en Lijfrentekas (ASLK). In a spirit of national solidarity, first the Belgian National Bank and then the Post Office allowed ASLK-CGER to use their counters to take in deposits, thus creating a powerful national network.

As ASLK-CGER proved to be highly popular, the government added a life insurance facility in 1889 and some years later, in 1903, set up inside ASLK-CGER the Caisse de Retraite pour les Accidents du Travail to provide workers with disability cover in case of work accidents. During the 1930s ASLK-CGER achieved spectacular growth, due largely to the State guarantee it enjoyed.

From State-owned bank to private bank

However, after the Second World War, when competition between banks was growing and the national political consensus was being eroded, ASLK-CGER’s role as a quasi-government agency administering savings, housing loans, pensions and insurance cover came to an end. ASLK-CGER opted to become a universal bank capable of providing all products offered by other banks. In 1980, its status was changed to that of a State-owned bank and insurer. Subsequently, in 1993, at the request of the government, the Fortis group took a 50% stake. Five years later, in 1998, Fortis took over Generale Bank and then merged it in 1999 with ASLK-CGER in Belgium to create Fortis Banque.

In spite of the profound changes in its environment, ASLK-CGER maintained remarkable continuity of purpose. The de facto monopoly on savings which it enjoyed until around 1950 gave it the confidence to give its staff a unique status underpinned by close collaboration between management and trade unions. The Bank developed its own unique company culture, based on service to society, providing social loans and many free services. At the same time, with its successful cross-selling of savings products, mortgage loans and life insurance policies, ASLK-CGER can be seen as an early pioneer of the ‘bancassurance’ approach.