How The East Was Won (3/3): Third time lucky in setting up in Japan

Comptoir d’Escompte de Paris opened a branch in Japan in 1867 to support French economic expansion in the Far East before opening branches in France. The Land of the Rising Sun had imperialistic urges in eastern Asia, however, which discouraged and ultimately blocked the aims of Banque de Paris et des Pays-Bas of setting up in the region for nearly half a century, despite the promising economic outlook in Japan. It was only in the 1960s that BNP and Paribas finally established a permanent presence.

Third time lucky in setting up in Japan

BNP and Paribas would profit from Japan’s strong growth to establish a permanent, long-term presence and become a vital player in Japanese banking.

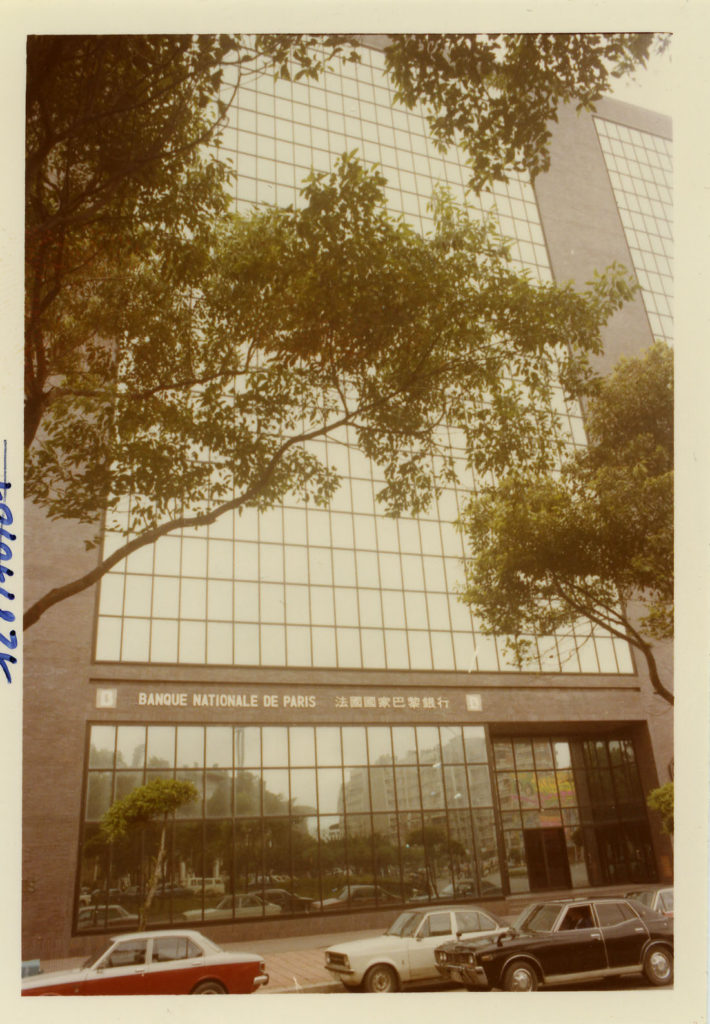

Growth in Japan from the 1960s onwards and for three decades was little short of spectacular. The Izanagi boom (1965-1970) made GDP grow by 11.5% annually, making Japan the world’s second largest economic powerhouse from 1968 onwards. It was also in 1968 that a representative office for BNP was opened in Tokyo that finally launched the group’s adventure in Japan. Banque de Paris et des Pays-Bas set up its representative office only in 1971 in a financial industry divided in two: Japanese giants and nearly 90 foreign banks.

BNP focused primarily on operations relating to international trade. On 31 March 1984, BNP was ranked third out of 77 foreign banks by balance sheet and seventh by client loans. By 1989, it was the number-one foreign bank by balance sheet and operating results. If we discount American banks and their special status owing to economic and political reasons, along with Banque Indosuez (present in Japan since 1948), BNP (with Crédit Lyonnais) is ranked in the top ten foreign banks according to these classifications.

Banque Paribas managed to position its strategy on the domestic market. In June 1979, Compagnie bancaire signed an agreement to acquire a 3% equity stake in Orient Leasing, while Cetelem pioneered by participating in the establishment of a Japanese consumer loans company. The agreement created one of the leading sources of financing in Japan in terms of investment capital since the war. Banque Paribas acquired “primary dealer” status in 1994 after obtaining a license as a special T-bond vendor throughout Asia.

Today, BNP Paribas Group boasts a solid presence in Japan with over 700 employees working in five separate entities undertaking investment and insurance operations.