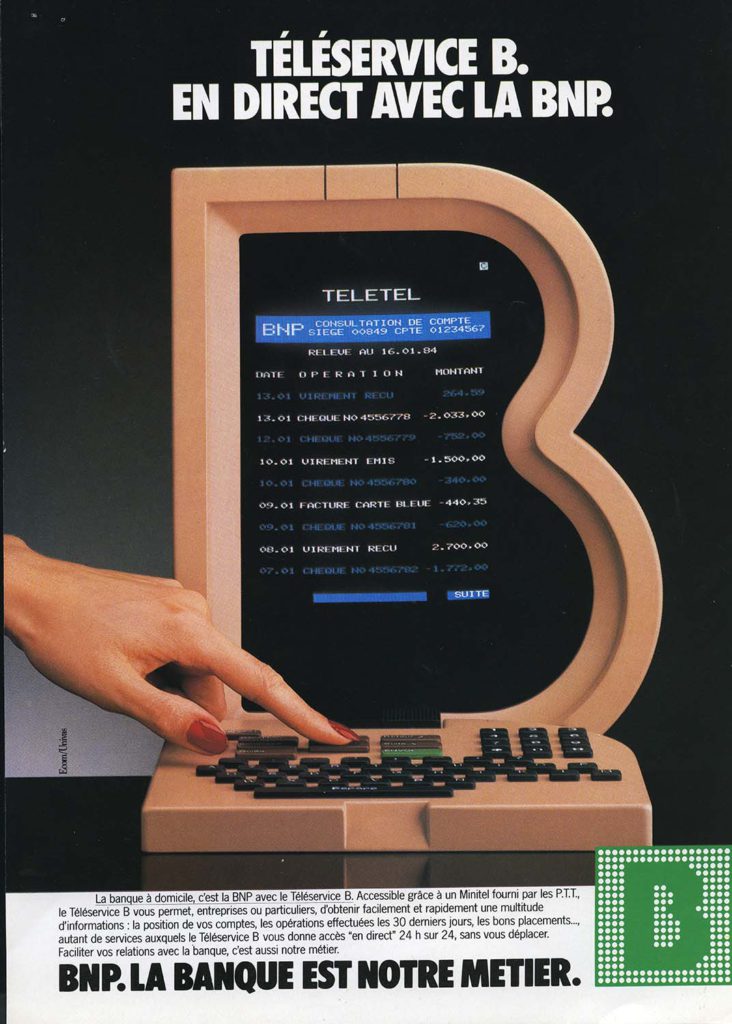

Telebanking B. Live with BNP

This poster, accompanied with the message “Telebanking B, BNP live,” shows a Minitel in service displaying a history of banking transactions. This is an advertisement promoting BNP’ s new data communications services that let customers equipped with a Minitel consult their accounts and receive varied information.

Between 1960 and 1980, telecommunications, information technology and television underwent major developments: telephone networks expanded and computers became more commonplace. Connecting these information processing components gave rise to the videotex technique. This process combines the telephone network’s ability to send and dialogue, computers’ processing and memory capabilities and the image provided by screens.

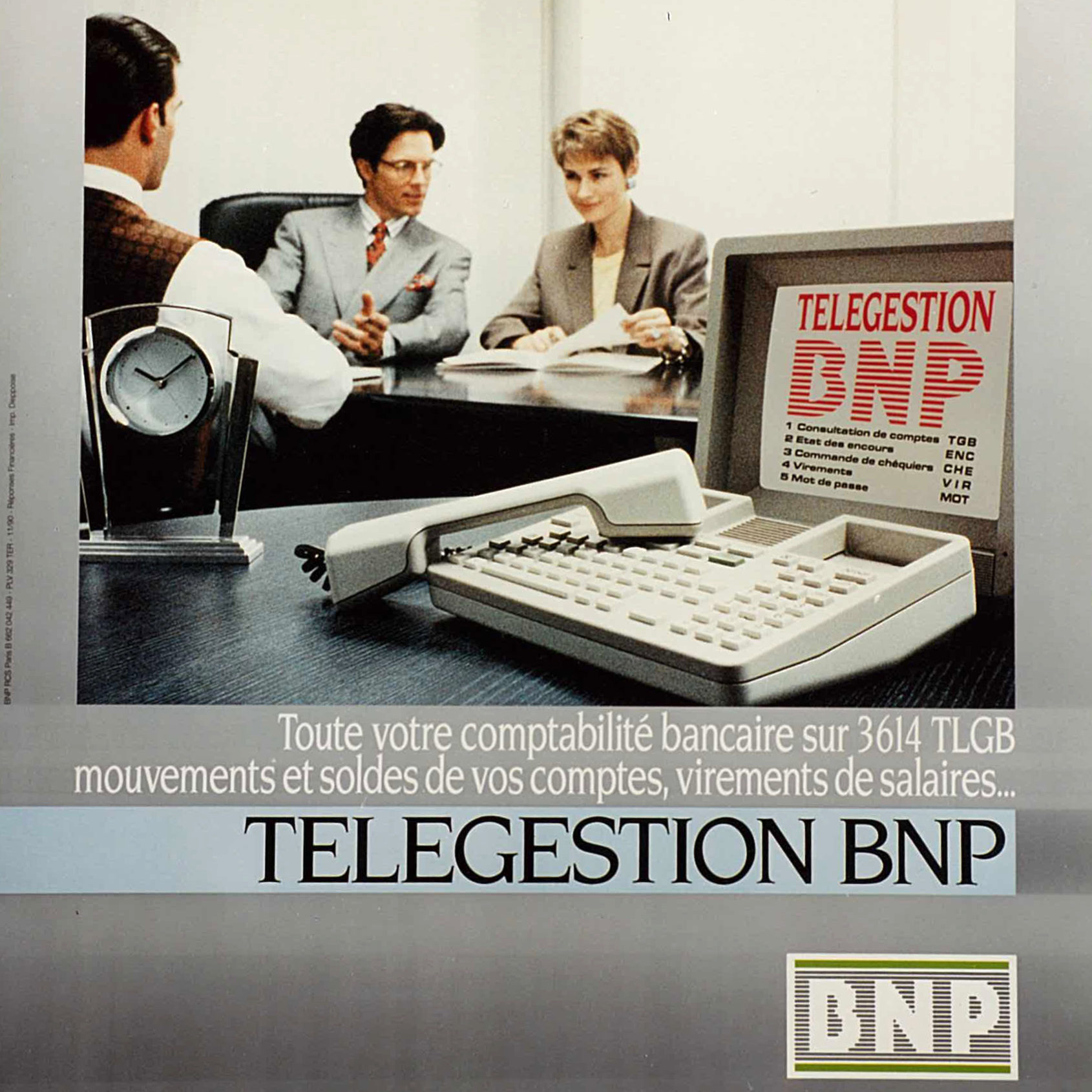

BNP was able to develop at home banking solutions based on these new technologies. In 1982, BNP took its first steps in telebanking when it tested 3 new services via Minitel with 500 customers. The first “BNP informs you” service offered a range of 25 products (bankcards, home savings plan, etc.) and practical information (e.g., branch hours, etc.). The second “Entertain yourself with BNP” service tells the bank’s story over time and can serve as an animated distraction in the branches equipped with 3613 BNPTEL. And the last “Telebanking B” service let BNP’s customers who want order a chequebook or currency, receive messages from their branch at home.

In the wake of the Minitel release in 1983, BNP offered the interactive Telebanking B service to its professional customers. This way it met their need to manage their cash flow in real time. Next, the Telebanking B service spread quickly to BNP’s retail customers, going so far as to promote the initiation into telebanking and personal computers through competitions organised by the Microtel Clubs.

BNP and the Crédit Agricole were the two French banks that invested the most in this area. The growth in data communication services was spectacular for BNP: 15,000 subscribers in 1984, 225,000 at the end of 1989.

This new commercial channel also let BNP lighten the branches’ daily banking operations (transfer orders, etc.) and therefore to improve the customer reception.