Banca Nazionale del Lavoro (BNL), loyal servant to the Italian economy

During its one hundred years of providing banking services, BNL has become a major driver of Italy’s development.

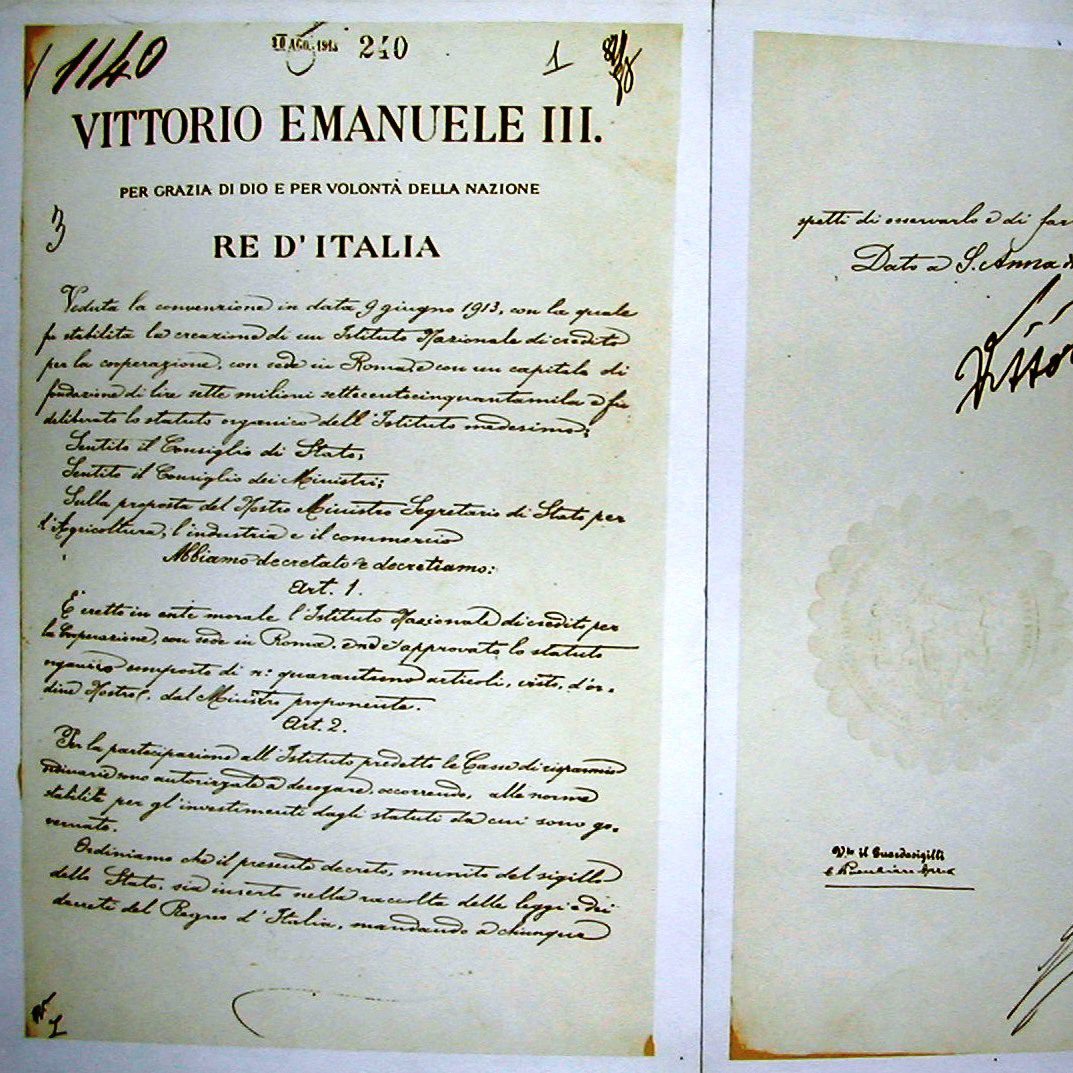

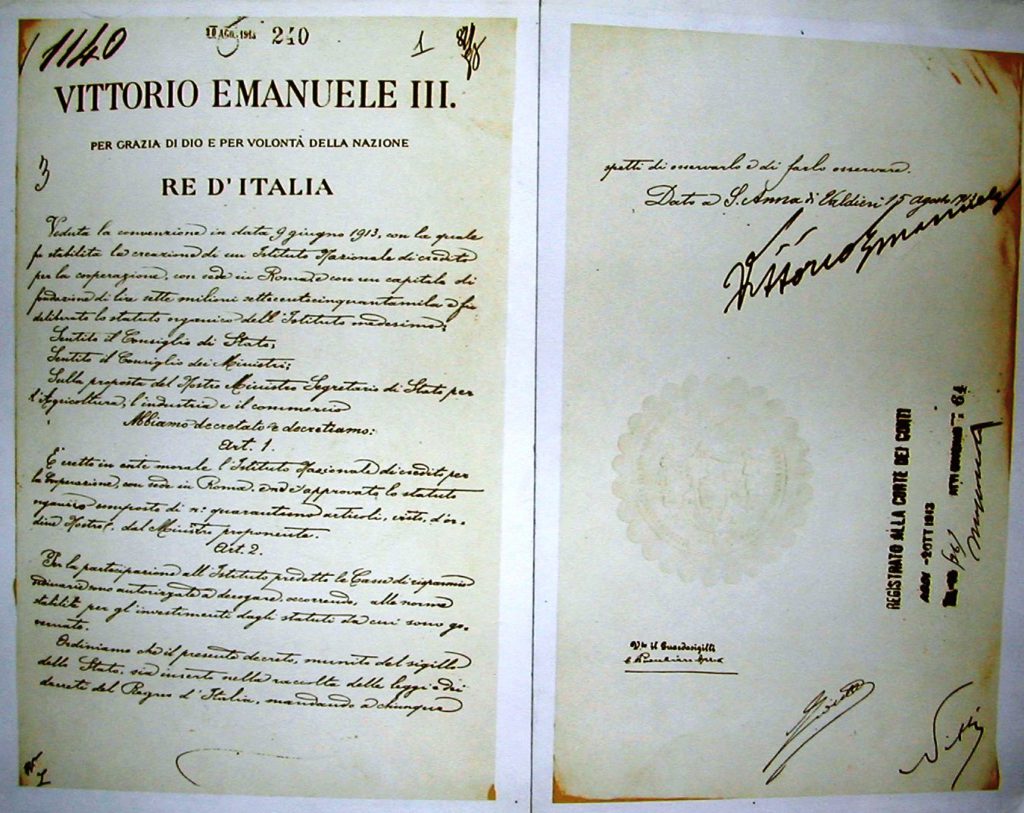

In 1913, on the initiative of the Italian government, the Istituto Nazionale di Credito per la Cooperazione was founded with a mission to support the expansion of the cooperative movement in Italy. At a time when the Italian economy was still extremely rural in character and in need of industrialisation, the new financial institution provided tailored services to the agriculture and fisheries sectors and also financed the Italian movie industry.

In the mid-1920s the cooperative system encountered a serious crisis and the new bank had to be restructured. In March 1929 the Fascist government decided to transform the bank into a state-run entity, under the supervision of the Treasury, and gave it a new name: Banca Nazionale del Lavoro. BNL’s main business was providing loans and it achieved strong growth, especially in its international network.

After the Second World War, BNL played an active part in Italy’s economic reconstruction and was closely involved both in the growth of the film industry and automaker FIAT’s plans for modernisation. The bank also had a key role in the ‘Green Plan’ – i.e. the disbursement of loans under the Marshall Plan to promote agriculture and development in the south of Italy.

By 1964, BNL had become the leading financial institution in Italy. However, its power waned with the slowdown in the economy during the 1970s.

Increasing competition, the process of bank sector liberalisation and the European drive towards open markets all led to structural reforms and to the eventual sale of BNL out of State hands: the bank was privatised in 1998.

In 2006, following a lightning operation which lasted just one week, BNP Paribas took control of BNL, thus making Italy BNP Paribas’ second ‘domestic’ market. By the time BNL celebrated its 100th anniversary in 2013 it had become a thoroughly modern bank.

Partager cette page