18 dates that made the history of payments

From the origins, people have been exchanging goods and services on the basis of monetary units, whether material or not, which have gradually been improved. Barter, shells, stones and cocoa beans were used as bargaining chips in transactions before the appearance of metallic currency. Then, over time and technological innovations, payment solutions have become dematerialized, moving from tangible currency to digital alternatives like the credit card. Focus on the main milestones that have marked this evolution.

Over 12.000 years ago…

Origin of payments

The first communities gave intrinsic value to some objects like shells, stones, materials, etc, for their transactions. For example, cauris, shells from the Pacific and Indian Oceans were used as payment. For important deals, these shells were assembled in bracelets or necklaces. Traces of this currency were found in China and Europe. In pre-Columbian America, cocoa beans were scarce and expensive, so they were used as currency. Elsewhere, tissues or snail shells were also used! These are primitive currencies.

Schomburg Center for Research in Black Culture, Art and Artifacts Division. “Cauris” Digital collections of the New York public library. 1700 – 1950.

From metallic money to paper money

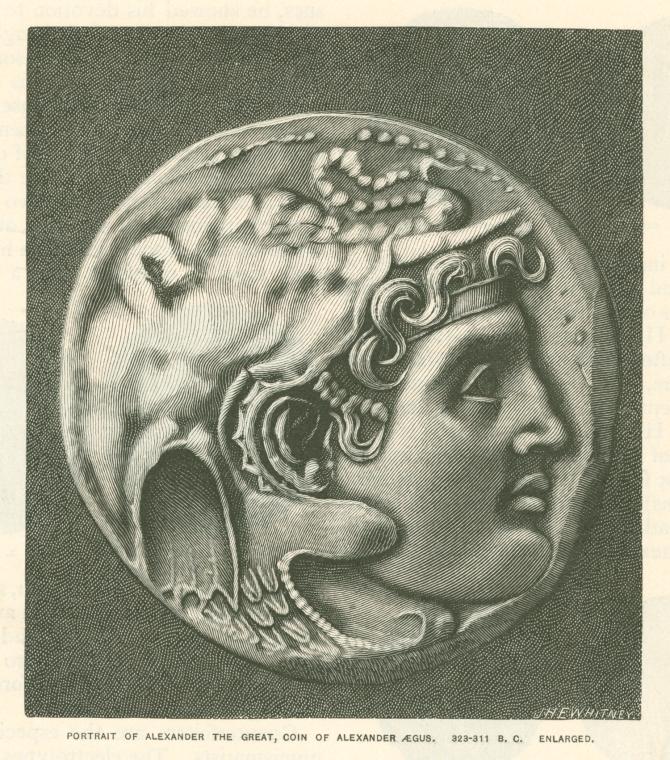

7th century B.C. – Coins of precious metal

According to Herodotus, the first gold and silver minted coins appeared among the Lydians, a people of today’s Turkey, in the seventh century BC. King Crésus, who reigned from -561 to -547 B.C., used this type of currency to pay his mercenaries. The coins, composed of a mixture of gold and silver, were decorated with a lion and a bull.

In 1360, King John II of France mints the first franc in gold.

Coin showing Alexander the Great, wearing an elephant cap, Digital collections of the New York public library , 1887.

End of the 10th century- China invents paper money

The first payment notes appeared in China at the end of the tenth century under the Song Dynasty (960-1279). They were printed with black ink on wooden or bronze plates.

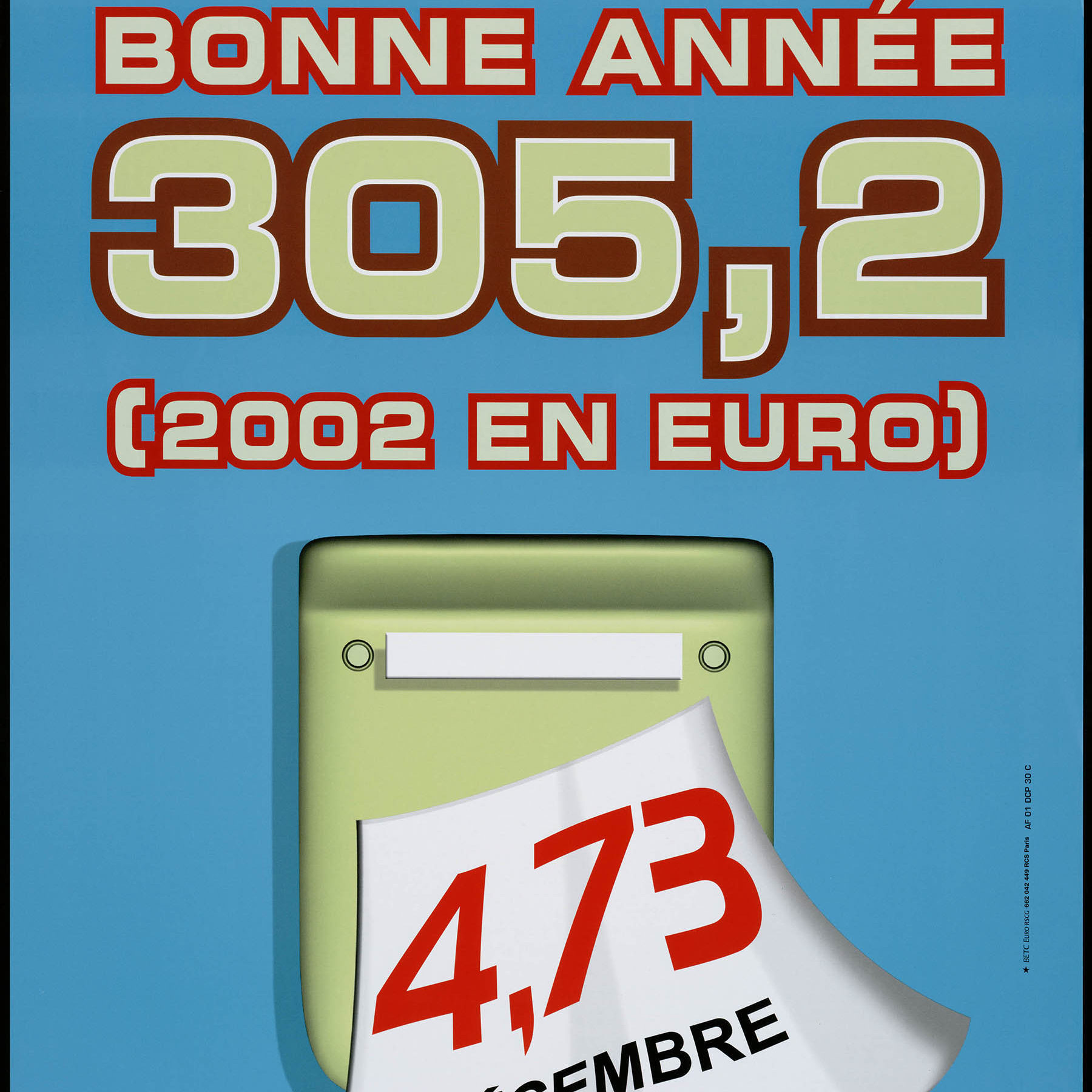

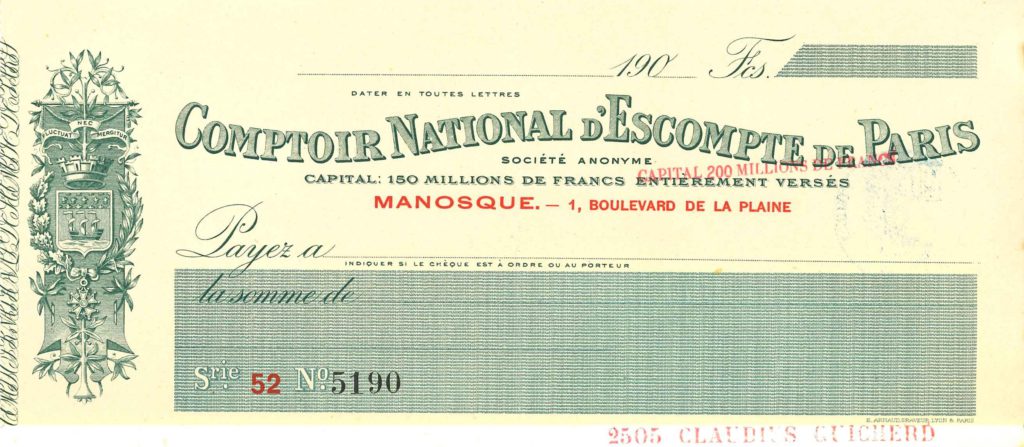

1742- Cheque from across the Channel

Created in England in 1742, the cheque was finally adopted by the French as a means of payment in 1865.

Within the European Union, the cheque keeps declining due to the fraud, the adoption of innovative payment solutions and high production and processing costs. However, France remains a major user with 1.5 billion cheques used in 2019.

Source : Paiements par chèques en France 2019 | Statista

Dematerialization of money and emergence of virtual money.

1967- Paying with a card

The Carte Bleue was launched in 1967 by five French banks: BNP, Crédit lyonnais, Société Générale, Crédit commerciale de France and Crédit industriel et commercial. Based on the American credit card model of the late 1950’s, this French innovation has been slowly accepted by merchants but became the first payment option for the French in 2003.

Withdrawing cash 24/24

The first cash machine was installed in 1967, in London, by Barclays Bank.

One year later, in France, the first cash withdrawals in the country was installed by the Société Marseillaise de Crédit.

The same year, BNP deploys machines named “BNP Express”. They allow its customers to withdraw 250 francs 24 hours a day, through personalized cards distributed in the branches. The card was kept in the machine after use and returned to the client’s address by the Post Office.

In 1971, the cash dispenser accepted payment cards with magnetic stripes.

The automated teller machine (ATM), a story of continuous improvments

In 1979, the Banque Régionale de l’Ain inaugurated the Multi-operator Automated Banking Card (MOA) at Bourg-en-Bresse (France) and imposed the concept of the ATM. This is a first in Europe. By the end of the year, BNP is also testing it.

In 1981, the bank deployed its own ATM, which offered new services to the customer: cheque deposits, balance calls, cash transfers and remittances, etc. Available 24 hours a day, these machines facilitated the independence of customers and supported the emergence of “self-service banking”.

Biometrics for ATM:

In 2006, biometric recognition and finger and hand venous networks were launched in Japan.

Source : Lancement de DAB biométriques au Japon | ADNews – Galitt

1984- Invention and generalization of the microchip

The National Smart Card Payment System (SNPC) was introduced in France in 1984 to interconnect ATMs of French banks. A world premiere!

The smart payment card was introduced in the late 1970s. This solution, which is more secure, was deployed throughout France in 1988 against fraud. It quickly replaces magnetic cards. In 1993, all cards issued in France were microchip.

1997- Deployment of contactless payment

The first experiments with contactless took place in Hong Kong in 1997.

The contactless device allows you to pay for your purchases via a telephone or an equipped card, without dialing your confidential code or inserting your card. The Near Fiel Communication (NFC) protocol makes it possible to exchange data at very short distances.

In 2007, it’s Turkey’s turn to develop this innovative solution thanks to the telecommunications operator Turkcell and the Mastercard network, which provide mobile devices equipped with NFC.

In France, experiments began in 2006 with the Pegasus project, which brought together several large banks, telephone operators and payment service providers Visa Europe and MasterCard. In 2010, in Nice, BNP Paribas offered the optional contactless on its cards and via a mobile application. This technology is then rapidly developing and becoming interoperable.

In France, for example, in 2013, there were 1.2 million payments with a contactless bank card and 4.6 billion in 2020.

Source : CB sans contact françaises : nombre de paiements 2020 | Statista

2001- Paypal: the online payment giant

Paypal was born in 2001 as a result of the merger between Confinity, a software development company and Xcom, an online banking offer. With this online payment and money transfer service, the customer don’t have to enter his banking information while paying online. This is a major milestone in the history of payment. The service has been very successful and keeps growing. In 2021, more than 426 million PayPal accounts were active worldwide.

Development of mobile and digital banking

2008- Mobile banking by Orange Money

Aimed at people who cannot afford to open a banking account, the Orange Money solution was launched in Africa in 2008. In particular, it allows the payment of water or electricity bills and the purchase of communications credit through a mobile. This reflects the development dynamics of emerging countries, known as “frog jumps.” It’s characterised by the direct accession of these countries to the latest technologies without going through intermediate stages.

2009- Bitcoin: the creation of a currency

January 12, 2009 marks the first bitcoin transaction between Satochi Nakamoto, the pseudonym of the creator or creators of this cryptocurrency, and Hal Finney, an engineer and video games developer. In October of the same year, the bitcoin reaches a value of $0,001, compared to several thousand today.

Picture : Bitcoin wallet by David Shares, Unsplash, free of charge

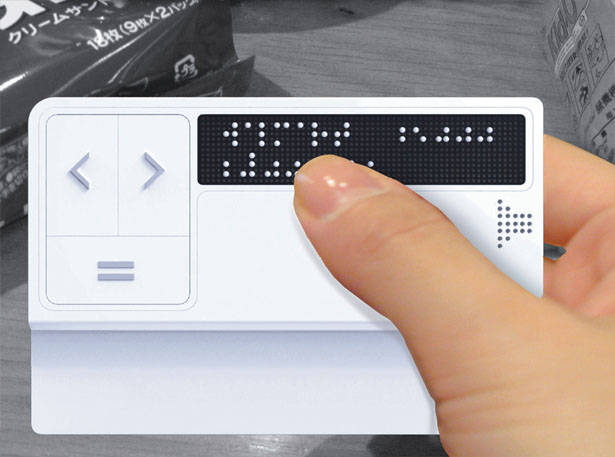

2010- Accessibility in payments

A Braille card is designed by the designer Kwon Ki Nam. It can read fingerprints and has loudspeakers to announce purchases made.

Focus :

41 million transactions in electronic money took place that year.

Picture : Kwon Ki Nam Braille card

2011- A mobile bank

BNP Paribas and Orange are partnering to create the first fully mobile banking offer in France. At the same time, the client can subscribe to a mobile phone with NFC, an adapted package, benefit from the free transfer of money to reimburse relatives and the contactless payment.

Picture : Advertising poster “BNP Paribas Mobile”, BNP Paribas Historical Archives, 2012, 5AF1873

2013- New online services

The 100% digital banking offer by BNP Paribas

To adapt to customer habits and the digitalisation of the banking market, BNP Paribas deploys Hello Bank! in 2013, an offer of banking services exclusively online.

A new online solution : Paylib

In the wake of Paypal and digital payment applications, several banking groups such as BNP Paribas, the Banque Postale and Société Générale are partnering to launch Paylib, a secure online payment service. A mobile application is available since 2016.

Picture : Advertising poster “Paylib by BNP Paribas”, BNP Paribas Historical Archives, 2013, 2AF379

2014- A year of innovation

The Nickel account : a new bank offer without a bank account

Aimed at every person from the age of 12 and with no possibility of overdraft or credit, this account can be opened on terminals at the tobacconist’s with an identity card and a telephone number. BNP Paribas became the majority shareholder in 2017.

The mobile POS machine of BNP Paribas

MOBO is a mobile POS machine produced by BNP Paribas. A card reader can be connected to a smartphone or a tablet so the professional can be paid anywhere. Only an application and an internet connection are necessary

Innovation means looking further

In January 2014, an application was designed in Turkey, specifically for Google Glass: Tt allows Türk Ekonomi Bankası (TEB) customers to locate the nearest ATMs and contact the bank’s customer service via video conference.

Technology at the service of micro-finance

At the same time, in Africa, microfinance institutions are using portable biometric identification boxes (fingerprints or iris scanning) to open an account for those who don’t have official identity documents.

2015- Smile, it’s paid !

Payment by selfie or facial recognition is developed by several companies such as Amazon, Mastercard, Alibaba, etc. and is based on the mobile phone camera.

This technology is still at a developmental stage in 2022 in Brazil for Mastercard in partnership with NEC, Payface, Aurus, PaybyFace, PopID and Fujitsu.

2016- A safety innovation : the dynamic cryptogram

In 2016, Société Générale developed and offered the first dynamic cryptogram card for its customers. The 3-digit code on the back changes regularly. This technological innovation aims to combat fraud, particularly in the context of online payments.

In 2018, BNP Paribas also developed this solution to guarantee its clients additional security for their payments.

Development of open-banking

2017- Simplifying payment with Fintechs

Supported by BNP Paribas, Lyf Pay is an all-in-one secured mobile payment application developed by the French Fintech LYF. It includes contactless payment, payment by a simple QR code scan or the possibility of saving loyalty cards.

2021- Secure payments with biometric cards

BNP Paribas offers biometric cards with embedded fingerprint readers. The customer must go in an agencie to record his fingerprint. Then, he can pay without contact by placing his finger on the reader, without the credit limit of 50 euros and in safety !

In the future ?

Cryptocurrencies are growing and could become the means of payment of tomorrow.

These are digital currencies based on the principle of the blockchain (which authenticates and records transactions in a decentralized system).

They are gradually accepted as an online payment, particularly within the metavers.

In this virtual world, with cryptocurrencies, you can acquire land, objects or accessories for your avatar (your alter ego online!).