Smart cards, a French invention that revolutionised payments (1/2) : before the chip

In 1974, a French engineer developed a ‘portable memory device’ that paved the way to the smart payment card at the end of the 1970s. Offering more security and the potential for new services, this solution was deployed throughout France in 1988, then started to be exported in 1997. Zoom in a cutting-edge technology that became an international standard.

From magnetic strip card to memory card

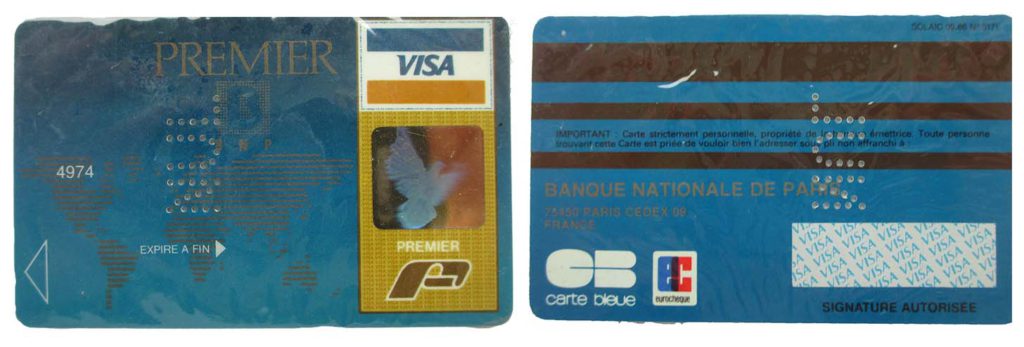

The history of the smart card goes back to the 1950s, when a number of inventors started entertaining the idea of a portable electronic object that could be used for transactions. But it wasn’t until 1974 that the dream became a reality with Roland Moreno’s invention. In 1971, the Carte Bleue (payment card used by large French banks) was equipped with a magnetic strip that allowed the use of a secret code and saved shopkeepers the trouble of having to send transaction slips to their bank. It was a real time-saver in transactions. Along with this technological development came the first automatic teller machines (ATMs), for which the magnetic strip card was originally designed before it was used on card-reader devices in shops. While magnetic strips gradually appeared on Cartes Bleues, it was only in 1979 that it became a global standard.

It was also at that time that the first electronic-payment trials started. Introduced in the merchant terminal, the magnetic strip card immediately sent a query to the bank’s computers to receive confirmation that the amount spent by the buyer had been authorised. The system considerably reduced the risk of fraud or improper use, but was also very costly and slow due to France’s telecommunications infrastructure.

For these reasons, the memory card was seen an alternative solution to online payments. Since it was possible to store data on the chip, it was no longer necessary to stay connected to the bank. A new technological revolution was under way, and a promising new market started to emerge.

Partager cette page