A promising industry meets a daring bank (1/3): the BNC and cinema’s debut

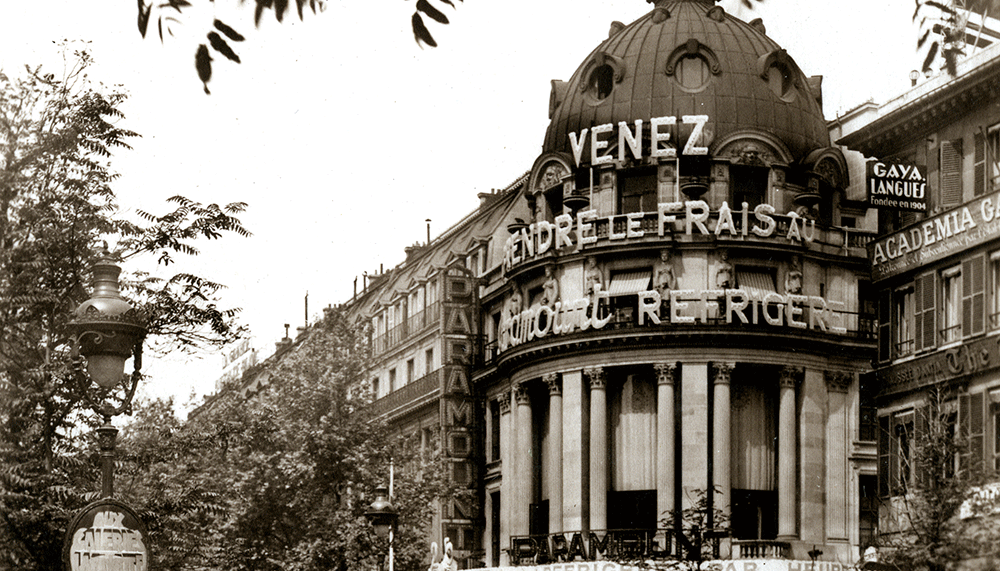

Moviemaking, an industry that first appeared in the late 19th century, required substantial investments from the outset. Though few commercial banks chose to be involved with this emerging business, the Banque Nationale de Crédit (BNC), forerunner of BNP Paribas, played an active role in financing the world of cinema between 1917 and 1932.

The BNC: a daring bank that supported cinema’s auspicious debut

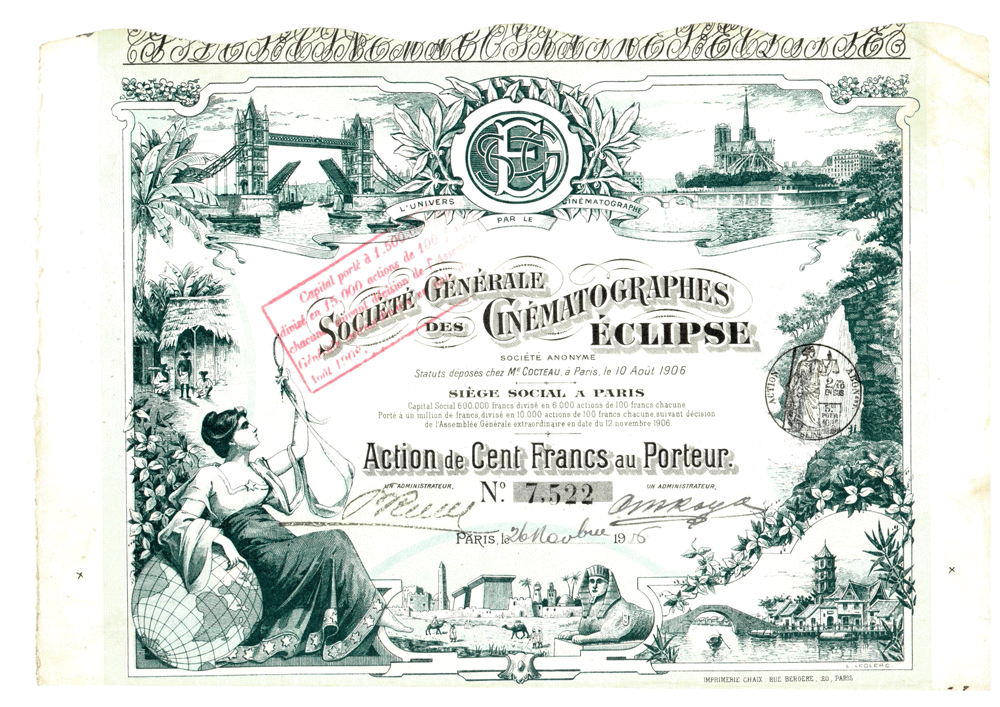

In the early 20th century, movies won over the general public and their success spawned a large number of film companies. Finding financing, however, remained an ongoing challenge for these ever-evolving companies. Banks were relatively reluctant to meddle in this industry that was known to be high-risk. By 1917, the BNC, which had been in business for just four years, had established a distinctive reputation for commercial pugnacity, uncommon in the banking sector. That year, it granted an initial loan of 300,000 francs (well over €600,000 in 2016 euros) to the Société Générale des Cinématographes Eclipse, a film production company founded in 1906. A bold choice spurred by the economic potential of this new industry and the tide of public enthusiasm for movies.

Between 1918 and 1920, two other companies, sound-equipment firm Continsouza and the Société Générale pour le Développement Industriel et Commercial de la Cinématographie, a film development company, also were awarded funding advances from the bank. In addition to direct financing, the BNC also made equity investments in the Franco-Film-Aubert firm and Continsouza, for which it provided account management services. The young bank thereby wholly embraced the new moviemaking industry and, starting in the Twenties, would play an even greater role in its expansion.