Smart cards, a French invention that revolutionised payments (2/2): across the world

In 1974, a French engineer developed a ‘portable memory device’ that paved the way to the smart payment card at the end of the 1970s. Offering more security and the potential for new services, this solution was deployed throughout France in 1988, then started to be exported in 1997. Zoom in a cutting-edge technology that became an international standard.

How the smart card won over French banks and the world

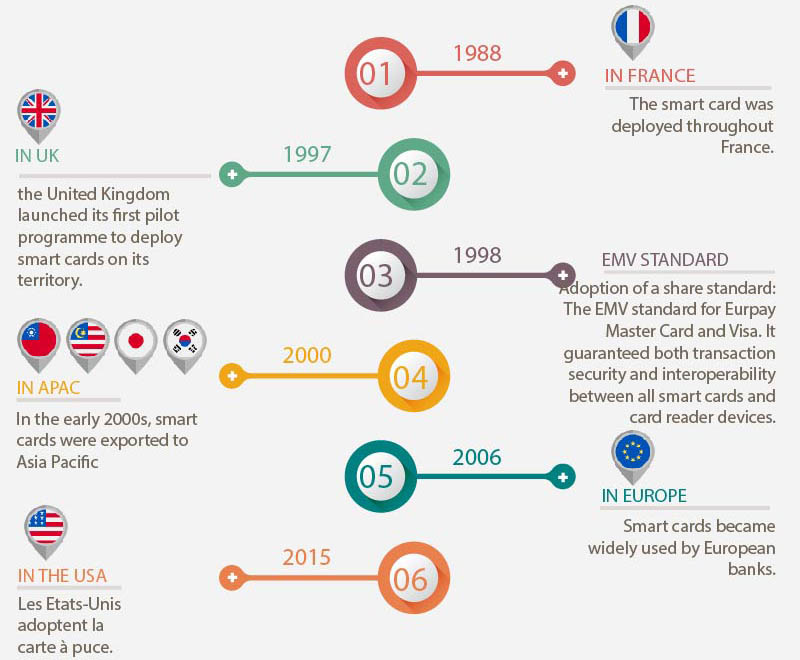

In the 1970s and 1980s, two payment systems were therefore competing: the magnetic strip and the memory card system. It took a few years before the smart card finally won the race. But its adoption was facilitated by the security requirements of French banks and the implementation in 1984 of a nationwide smart-card payment system. France thus became the first country in the world to interconnect all its ATMs, regardless of the bank. More secure than the magnetic strip, the chip card was deployed throughout France in 1988. Launched to guarantee the security of transactions, this card met the expectations of banks, which saw a 9% decrease in fraud from 1988.

In 1993, all bank cards issued in France came with a chip. Smart cards took a while longer to gain a foothold in the rest of the world. Most countries remained loyal to the magnetic strip card, as the cost of fraud appeared to be lower than that of adopting smart cards. It was only in 2006 that smart cards became widely used in European banks.

Since it first appeared in the 1980s, the smart card has continued to develop to the point where it has now become an embedded computer. Use of the smart card was initially limited to withdrawal and payment, but new services were later added such as remote payment. While its use became widespread in Europe in 2006, the adoption of smart cards took longer on the other side of the Atlantic because of local specificities. There used to be no unified bank-card payment ecosystem in the United States, and the occurrence of fraud was very low there compared with Europe. Americans would have as many bank cards in their wallet as the number of banks that they used. Things have changed. Since October 2015, American stores that do not accept smart cards are held responsible in cases of fraud.

The smart card across the world

Lire également